Back-to-school: 403(b) Plans

September 16, 2019

At the time of this writing, it is mid-September. The air is beginning to chill, the leaves are starting to turn, but most importantly your kids are now back in school. This makes it the ideal time to talk about 403(b) plans, the savings vehicle most commonly used by teachers (and others in the not-for-profit space) to save for retirement.

If you understand 401(k) plans, you mostly understand 403(b) plans as well. 403(b)s are Defined Contribution plans where the participant’s money is tucked away for tax-deferred growth. Traditional Defined Benefit pension plans for teachers are critically underfunded, and many states have been forced to cut benefits for future retirees. Depending on a DB as a primary source of retirement income can have devastating consequences (just ask the auto workers), which brings us back to 403(b) plans.

According to the Bureau of Labor Statistics, there are approximately 20 million eligible 403(b) participants (both educators and non-profit employees) across the country, which suggests that there are probably about 200,000 403(b) plans. We don’t know what the actual number is, because of one of the most significant differences between 403(b) plans and their 401(k) cousins: ERISA status.

ERISA, the Employee Retirement Income Security Act, provides participants and plan sponsors with certain basic protections and safeguards. The problem is that not all 403(b) plans are ERISA-qualified. In fact, most of them are not. Let’s examine what makes a 403(b) plan ERISA qualified and what that means.

The “default” setting on a 403(b) plan tends to be that it is not ERISA qualified. To qualify for an exemption from ERISA, a 403(b) has to meet certain criteria. There are a lot of them, but it mostly boils down to 3 things:

- Participation in the plan is completely voluntary

- The only form of plan contribution allowed is the employee deferrals. In other words… NO EMPLOYER MATCH.

- The employer doesn’t become too involved in plan administration

The first item on this list is pretty self-explanatory; you can’t force people into the plan or mandate participation. Items 2 and 3 are actually variations on the same theme, though I broke them out here as separate items because I’ve seen #2 trip up a lot of employers. Essentially, in order to maintain an ERISA-exempt 403(b) plan the sponsor has to stay as far away from the plan as possible. The role of the sponsor in this situation is to set up the plan, hire a good TPA to manage said plan, and run for the hills. The more involvement a sponsor has in the 403(b), the more likely it will be that the 403(b) loses its ERISA exemption.

Running an ERISA-qualified 403(b) plan is not a bad thing, necessarily. The upside is that ERISA-qualified plans are generally exempt from state laws because they’re governed by federal ones. This, of course, is super useful if you are a non-profit with employees in multiple states. Sponsors of ERISA-qualified plans can be as involved as they want, making decisions on plan design, dropping in employer matches, and generally ensuring the plan stays in compliance. Both sponsors and participants are also protected by the weight of ERISA. For Sponsors, this means that they are protected from liability for losses arising from the investment decisions of the participants (as long as they meet ERISA 404(c) requirements). For participants, it ensures transparency into fees and other aspects of plan administration, courtesy of the Form 5500 ERISA disclosure document. The downside for a plan sponsor is that now they’ve actually got to file a 5500 and comply with all aspects of ERISA.

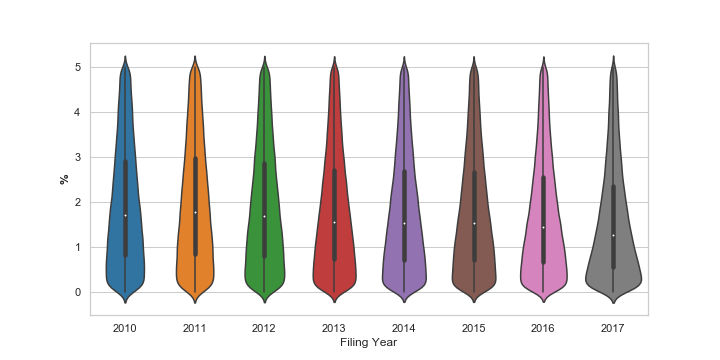

Speaking of 5500s, just how many 403(b) plans out there are actually filing? Here’s a look at the number of ERISA-qualified 403(b) plans over the last six years.

You can see from the chart that the number of ERISA-qualified 403(b) plans is declining (though in the interest of full disclosure, the 2018 number is an estimate based on the ~40% of 2018 filings currently available). By my estimate, this means that of all the 403(b) plans out there only about 10% are ERISA-qualified.

There are a number of possible, even probable reasons for this decline. In 2012, the Department of Labor clarified its position on whether or not an employer match is enough to subject a plan to ERISA (yes, it is). This caused some sponsors to unexpectedly find themselves with an ERISA plan they didn’t want, and some have been remodeling their plans to regain an ERISA exemption. Additionally, the introduction of the fiduciary rule has given rise to more TPAs who offer a full, turnkey solution, which is exactly what a 403(b) sponsor needs if they want to be exempt.

So as you are attending “meet the teacher” and “back to school” sessions, make sure you ask your children’s educators about their 403(b) plan. Unless, of course, you work for the school district, in which case you may be inadvertently waiving your ERISA exemption.

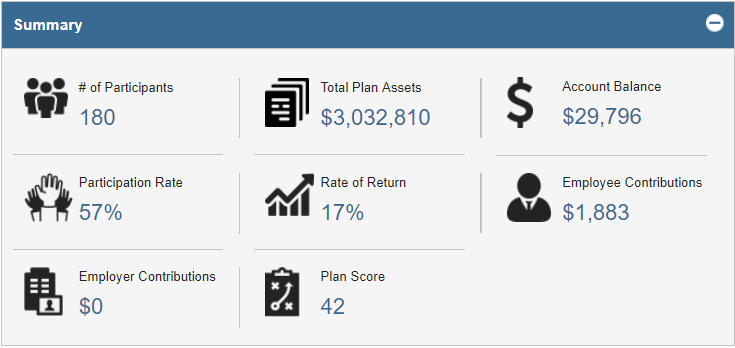

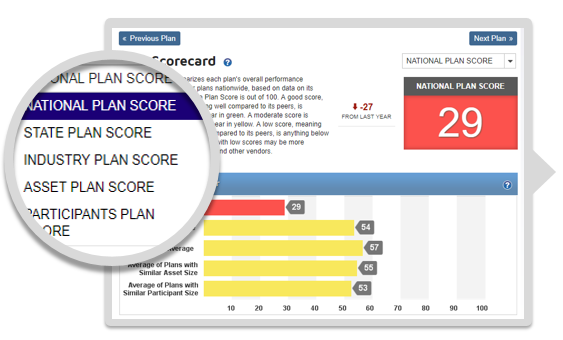

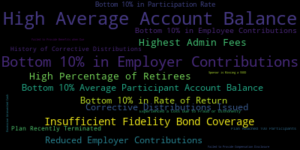

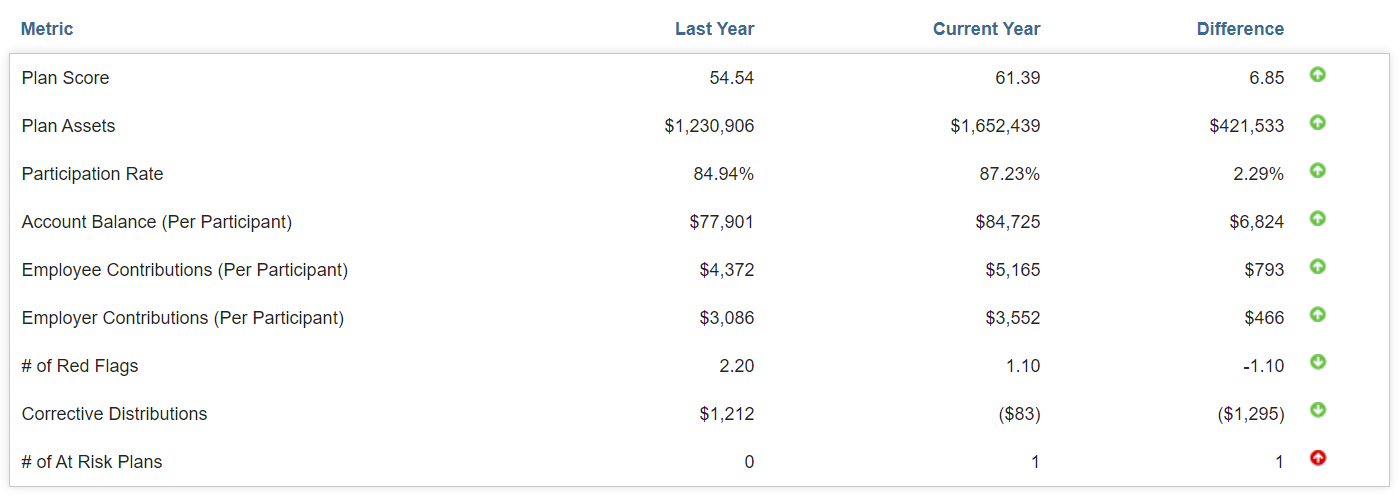

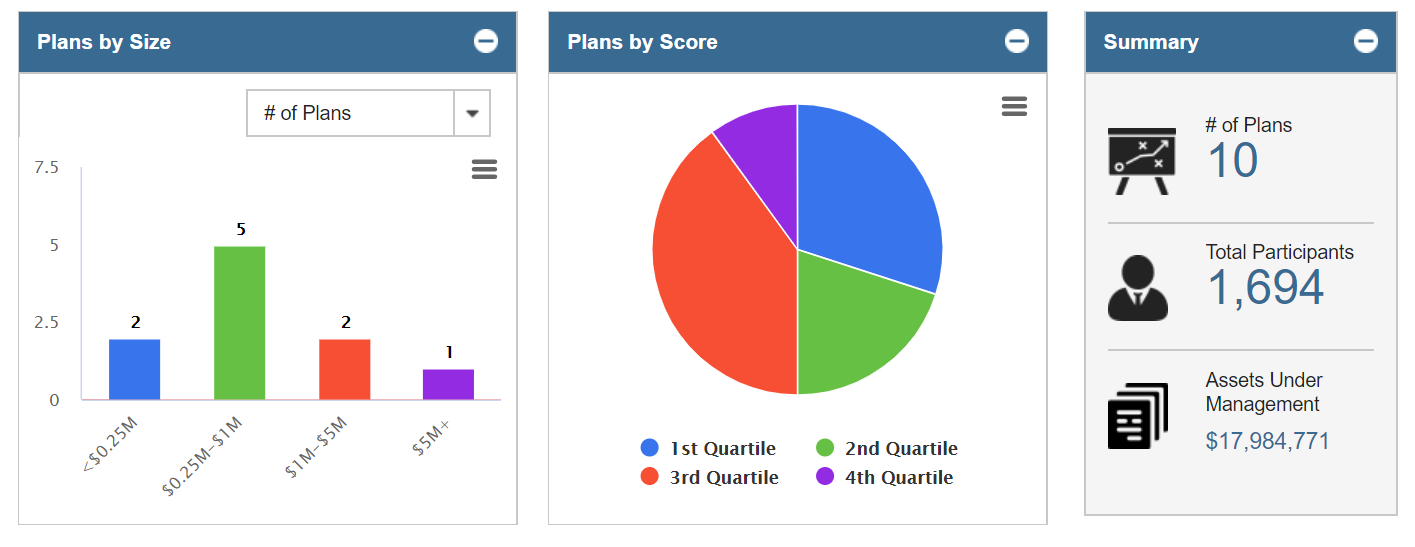

analytic tools to help. At the high-level view, you can maintain the general summary of your book of business (Number of Plans, Total Participants, and Assets Under Management). Additionally, you can see the breakdown of the plans under your management by Plan Size and Plan Score.

analytic tools to help. At the high-level view, you can maintain the general summary of your book of business (Number of Plans, Total Participants, and Assets Under Management). Additionally, you can see the breakdown of the plans under your management by Plan Size and Plan Score.